Innovation Management: Idea Selection and Portfolio Management

The second phase of the innovation process is the idea selection phase. Not all the creative ideas of employees are valuable for the organization. Some ideas may not be financially feasible, while others fall outside the organization’s competitive scope. The goal of the idea selection phase is to select promising ideas that can be futher developed into a novel product or service.

Organizations can manage the idea selection phase by developing a portfolio of different projects. Portfolio management is a resource allocation problem: assigning a fixed amount of resources—like money and production capacity—to a limited amount of projects. A succesfull portfolio management strategy spreads risks, targets different time horizons, and makes sure that projects are not duplicated.

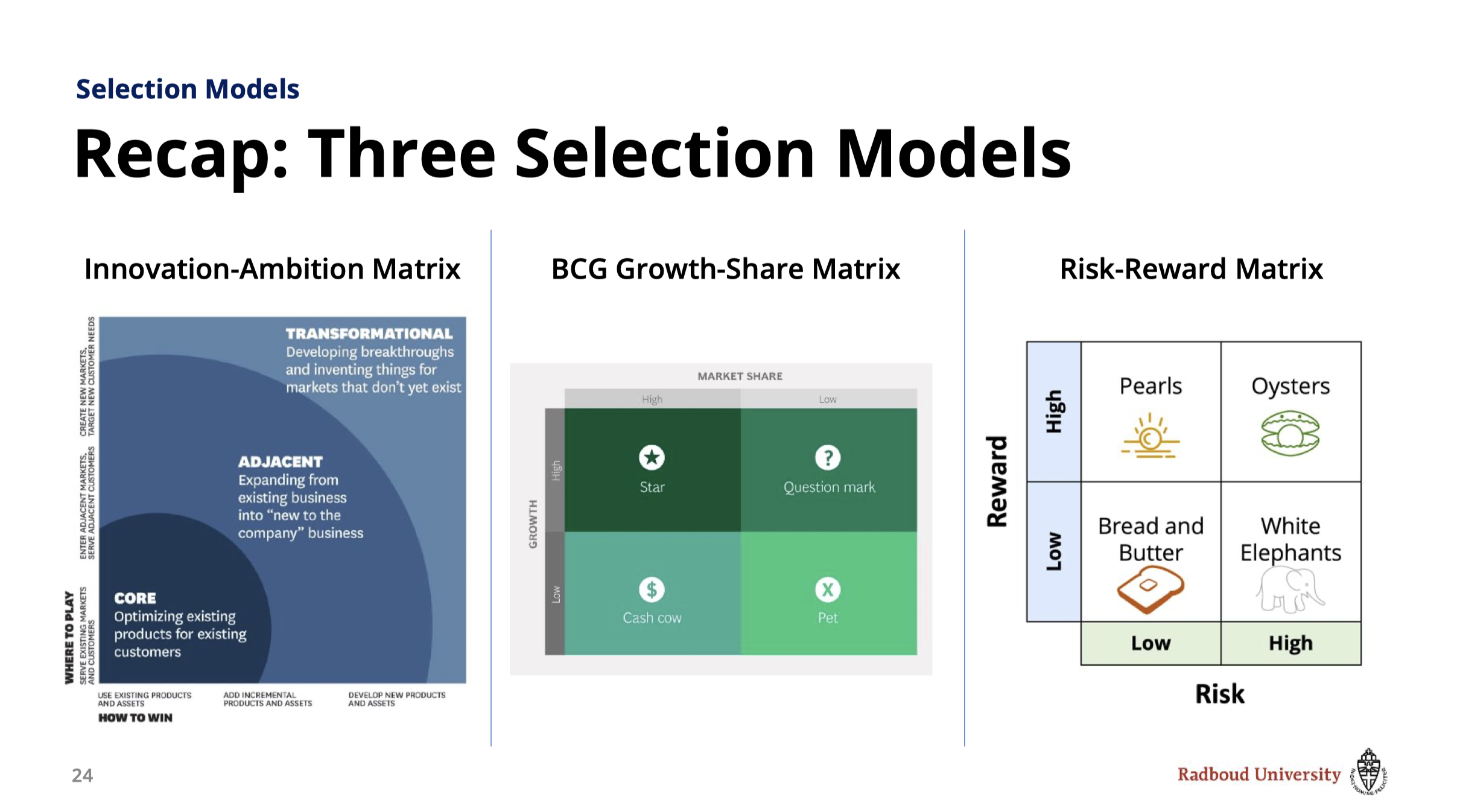

So how can organizations select and prioritize the right projects? We will discuss three of the most commonly used prioritization method: the Innovation-Ambition Matrix, the BCG Growth-Share Matrix, and the Risk-Reward Model.

The Innovation-Ambition Matrix has been developed by Nagji and Tuff (2012) to map an organizations projects on three levels of ambition. Core projects optimize existing products or services for existing customers. Adjacent projects expand existing products or services to “new to the company” products or services. Finally, transformational projects develop breakthrough ideas targeting new customer needs. Organizations need to spread their projects across the three levels of ambition to ensure long-term growth.

The BCG Growth-Share Matrix has been developed by the Boston Consulting Group to priorite different businesses by their degree of profitability. The two axes of the matrix divide businesses or projects into four different types. For example, high growth and high market share businesses are considered “stars”. Organizations should invest in these projects because they have high potential value. Low growth and low market share businesses—the “pets”—should be liquidated because they offer little return on investement.

Finally, the Risk-Reward Model (see, for example, Matheson and Menke, 1994 classifies projects based on the likelihood of success and their potential commercial value. For example, “bread and butter” projects have a high probability of success but relatively low commercial potential. Organizations need to invest in these projects to maintain or improve short-term performance. Oysters, in contrast, are breakthrough projects. Their potential value is high, but their probability of success is low. Organizations should nurture these projects over longer periods of time.

Literature

- Kester, L., Griffin, A., Hultink, E. J., & Lauche, K. (2011). Exploring portfolio decision-making processes. Journal of Product Innovation Management, no-no. https://doi.org/10/d4dpmt

- Nagji, B., & Tuff, G. (2012). Managing your innovation portfolio. Harvard Business Review, May, 67–74. https://hbr.org/2012/05/managing-your-innovation-portfolio

Innovation and Entrepreneurship in Context

This lecture is part of the course Innovation and Entrepreneurship in Context 2021-2022 at the Radboud University Nijmegen. The course is compulsory for students of the Master of Science (MSc) specialization in Innovation and Entrepreneurship.

The course has three lecturers: Caroline Essers, Yvonne van Rossenberg, and me. I gave four lectures on innovation management:

- Innovation Processes and Innovation Management

- Idea Development and Relational Analytics

- Idea Selection and Portfolio Management

- Idea Implementation and Organizing for Innovation

Related Posts

Teaching Lectures

Teaching Lectures

A lecture on innovation management, focusing on the implementation of ideas and the design of an innovative organization.

Teaching Lectures

A lecture on innovation management, focusing on the generation of ideas, social networks, and social capital.

Teaching Lectures

A lecture on innovation management, focusing on technological trends and innovation processes.